Has the Secure Act Affected Long-Term Care Planning? Attorney Jenna Franks Discusses in Episode 2 of Second Half of Life Podcast Season 2

The federal SECURE Act was signed into law in late 2019 and took effect on Jan. 1, 2020, so we're currently in the third year of this legislation. Given how drastically it changed how certain retirement accounts can be passed onto certain beneficiaries, it is something that we need to keep top of mind when advising our clients on the best road to take as they map out their estate plan. In the Second Half of Life Podcast, season 2, episode 2, Attorney Jenna Franks discusses the SECURE Act's effect on estate planning, based on the firm's experience in planning with clients over the first year of the law being in effect. While originally given to a group of professionals, this presentation can be helpful for those about to begin their estate planning and those that have already done some planning, but who could be affected by the provisions in the SECURE Act. Jenna also gives a few case examples of how the SECURE Act has affected hypothetical clients with certain IRAs to pass to their heirs after they pass.

All episodes of the Second Half of Life Podcast can be found on the Steinbacher, Goodall & Yurchak website, as well as on most podcast directories, which includes Apple Podcasts, Spotify, TuneIn + Alexa, iHeartRadio, Stitcher, Podcast Addict, Google Podcasts, Podchaser, Deezer, Listen Notes, Bullhorn, Overcast, Pocket Casts, Castro, Castbox, Podfriend, Player FM, Podcast Index and Pandora.

Eleven SGY Staff Members Earn Certified Dementia Practitioner® Credential; Nineteen Team Members Now CDPs®

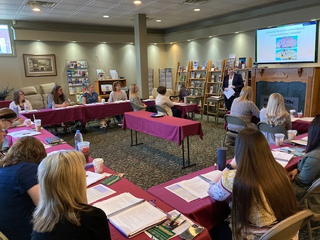

A total of 11 staff members from the elder law firm of Steinbacher, Goodall & Yurchak earned professional certification as as a Certified Dementia Practitioner® (CDP®) through the National Council of Certified Dementia Practitioners (NCCDP) at an all day training held at the firm's Resource Center in Williamsport on May 11, 2022. This brings the total of SGY team members that have earned the CDP® designation to 19. A full list of those staff members that earned it yesterday and already have it is below.

Attorney Julie Steinbacher, the founding shareholder of SGY, Attorney Jenna Franks, a partner of the firm, Long-Term Care Planner Kristin Daugherty, and Jasmyn Winey, administrator at Nippenose Valley Village, a retirement community located in Williamsport, led the training. All four are Certified Alzheimer’s Disease & Dementia Care Trainers®, which allows them to train others to become CDPs®.

The CDP® designation represents individuals that have received comprehensive knowledge in the area of dementia care and achievement in completing the Alzheimer's Disease and Dementia Care course/seminar. The CDP® also commits to ongoing professional development through NCCDP Staff Education Week or other educational opportunities and re-certification every two years. The NCCDP remarks that the "CDP® certification reflects a deep personal commitment on the part of the front line staff, health care professional and the organization’s sense of accountability by abiding by the NCCDP ethics statement, inspiring confidence and dedication in an individual's professional knowledge through quality of life and quality of care provided by the CDP® to the dementia patient." The goal of the NCCDP is to develop and encourage comprehensive standards of excellence in direct-care skills, education, and sensitivity in the area of dementia care.

The following SGY staff members and attorney partners are now CDPs®. Their position and primary office location(s) are also included.

*Attorney Chris Bradley (Williamsport/State College)

Kristin Daugherty, Long-Term Care Planner (State College)

Attorney Jenna Franks, Partner (State College)

Attorney Landon Hodges, Partner (Williamsport/Wyalusing/Wysox)

*Attorney Megan Ingram (Williamsport/State College)

*Haley Jenny, Legal Assistant (State College)

*Heather Mendler, Long-Term Care Planner (Wyalusing/Wysox)

*Kathy Morrison, Care Coordinator (Wyalusing/Wysox)

Kiley Myers, Paralegal (Williamsport)

*Jessica Oakley, Long-Term Care Planner (Wyalusing/Wysox)

Holly Reigh, Specialized Care Planner (State College)

*Janelle Scillia, Legal Assistant (State College)

Attorney Brittany Smith (Williamsport)

Attorney Julie Steinbacher, Partner (Williamsport)

*Samantha Tompkins, Care Coordinator (Williamsport)

Samantha Tressler, Legal Assistant (Williamsport)

*Briella Walk, Legal Assistant (State College)

*Angel Yost, Administrative Assistant (Williamsport)

*Tammy Zilske, Long-Term Care Planner (Williamsport)

* Indicates they earned or renewed CDP® credential at May 11 training

Steinbacher, Goodall & Yurchak serves clients that have been diagnosed with Alzheimer's and Dementia, and assists those clients and their families with long-term care plans, asset protection, care coordination and more. More information is available on caring for loved ones with Alzheimer's and Dementia. To schedule a consultation, call 1-800-351-8334.

Second Season of Second Half of Life Podcast Begins With Episode on How to Beat Death & Taxes

The only certainties in life are death and taxes. Everyone has heard that saying and it is largely true. While none of us can avoid either, there are ways to reduce your tax burden - both in life and death - and most importantly, have your wishes fulfilled after you pass with respect to your estate. In this respect, while you can't avoid them, you can certainly beat them. How to do so is discussed in the first episode of the second season of the Second Half of Life Podcast. In this episode, Attorney Brittany Smith and Long-Term Care Planner Tammy Zilske give tips for effective estate administration, so that you can allow a difficult time for your family to be made easier while ensuring that appropriate decisions are made on final distribution of your estate. Among the topics discussed are understanding the probate process, guidelines and time frames, rules governing state and federal estate inheritance and estate taxes, the importance of naming trusted beneficiaries, legal documents that protect a spouse after the other spouse passes, and much more.

All episodes of the Second Half of Life Podcast can be found on the Steinbacher, Goodall & Yurchak website, as well as on most podcast directories, which includes Apple Podcasts, Spotify, TuneIn + Alexa, iHeartRadio, Stitcher, Podcast Addict, Google Podcasts, Podchaser, Deezer, Listen Notes, Bullhorn, Overcast, Pocket Casts, Castro, Castbox, Podfriend, Player FM, Podcast Index and Pandora.

Visit PlanningandProtecting.com to find an elder law attorney in your area!

Get the answers you need

Question or CommentDo you need assistance finding the information you need? Have a comment about our website or services? Click the button below to send us an email! We're always happy to help.